Forfaiting is a convenient, bank approved, form of funding, offering short and medium term financing (usually to 5 years repayment) to overseas clients.

A bank of “good standing” in the buyer’s country guarantees the repayment of the funding by issuing “post dated” Bills of Exchange, that mature over the financing period. These Bills of Exchange are guaranteed by the bank by placing an “AVAL” stamp on the B/E which gives the full financial undertaking in the bank’s name.

The cost of the financing facility is made up of two elements. The first is the “LIBOR interest rate” element, which is the base-line funding rate that is established by the international banking community. The second element is the “risk interest rate” element that is calculated to cover the various risks of the transaction as described in clause 6 below.

Both “rates” are usually fixed on the day the guaranteeing bank signs the bills of exchange (although commitments prior to signature may be obtained) and is fixed for the duration of the repayment period. These two elements are combined into an overall “composite interest risk rate”, which is then annotated on the bills of exchange as a fixed interest charge, which is added to the capital sum.

Please ask for an example of the calculation.

This facility has distinct advantages for the overseas buyer over conventional forms of international trade. These are as follows:

- No Letter of Credit is required, thus speeding up the transaction time and reducing administrative burden,

- No bank confirmation charges associated with a letter of credit,

- Up to 100% funding for the total contact is available,

- The buyer has the option to receive quotations to either:

fix the interest charge during the bid/proposal period (say up to 60 days) with the same rate applying to the whole financing period, or,

fix the interest rate at the point of contract signature which would apply to the whole financing period, or,

have the interest rate floating for the duration of the bid and financing period, - Goods can be sourced from a number of countries,

- There are no hidden extra costs. The “composite interest risk rate” covers the following:

• Commercial Risks.

• Political Risks

• Transfer/payment risk

• Foreign exchange risk

• Interest rate fluctuation exposure

• All administrative costs - It provides an alternative form and source of financing,

- Attracts no publicity,

- Increases and diversifies borrowing capacity for the overseas client,

- Speeds conclusion of commercial contract,

- Substantially reduces administration and legal costs incurred in a normal buyer credit loan agreement.

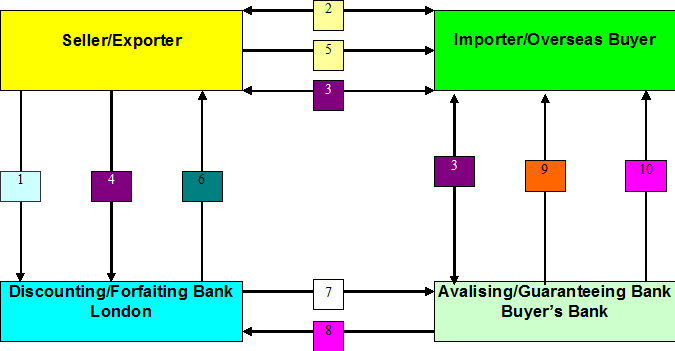

The Supplier Credit / Forfaiting Structure Explained

The above is a step by step guide to the financing facility:

- KJC Ltd obtains commitment to purchase the Bills of Exchange from a London Bank and signs the “supplier credit financing contract” with the bank.

- The seller signs a commercial contract with the buyer.

- The buyer confirms with his guaranteeing bank the facility arrangements and the bank delivers the guaranteed/avalised Bills of Exchange to the seller.

- The seller delivers the Bills of Exchange to the “Discounting/Forfaiting Bank” in London.

- Construction and delivery of the goods is arranged and effected.

- Contractually agreed payments are released to the seller equating to the discounted face value of the Bills of Exchange (capital sum).

- As the Bills of Exchange mature the “Discounting/Forfaiting Bank” presents the Bs/E to “Guaranteeing/Avalising bank” for immediate payment.

- The “Avalising/Guaranteeing Bank” pays the “Discounting/Forfaiting Bank.

- The “Avalising/Guaranteeing Bank” seeks reimbursement from the Buyer.

- Bills of Exchange are returned to the Buyer.

Please contact us for a no obligation chat.